Cum-Ex

The latest investigations by the Cologne public prosecutors office now raise the suspicion that a Scholz employee could have deleted emails in the Cum-Ex affair including some potentially evidentiary messages writes the. Bundeskanzler Olaf Scholz SPD hat am Freitag zum zweiten Mal vor dem Parlamentarischen Untersuchungsausschuss PUA im Hamburger Rathaus zur Cum-Ex-Affäre ausgesagt.

The Cumex Trading Scandal What Are The Implications For The Uk Articles 5sah

However the wider scheme carried out in the first.

. Unter CumEx-Files veröffentlichte am 18. Kanzler Olaf Scholz muss am Freitag erneut im Hamburger Untersuchungsausschuss zum Cum-Ex-Skandal aussagen. Cum-ex transactions were supposedly made impossible in Germany at the start of 2012 and the related cum-cum transactions in 2016.

The two UK bankers organized sham share trades to claim tax rebates twice. 1 The CumEx-Files is an investigation by a number of European news media outlets into a tax fraud scheme discovered by them in 2017. Die Affäre um die Warburg-Bank aus der Hansestadt zieht sich seit Jahren.

Seit Bekanntwerden der Tagebücher. It refers to an aggressive variation of dividend arbitrage in various European jurisdictions now considered. German efforts to stamp out cum-ex with legislation in 2007 and 2009 left holes through which certain types of financial players could still crawl.

As for the cum-ex part surprisingly for. Warburg Chief Executive Christian Olearius became the first leading banker to be charged for allegedly taking part in the controversial Cum-Ex scandal that cost. In the scheme investors rely.

1 day agoCum-Ex scandal. Dividend stripping is the practice of buying shares a short period before a dividend is declared called cum-dividend and then selling them when they go ex-dividend when the previous. New allegations after investigations by the Cologne public prosecutor.

Cum-ex is a term that many people outside trading floors have not yet heard of. A cum-ex scheme also known as dividend stripping is a tax avoidance scheme. Cum-Ex-Skandal Bankier suchte Hilfe bei Scholz.

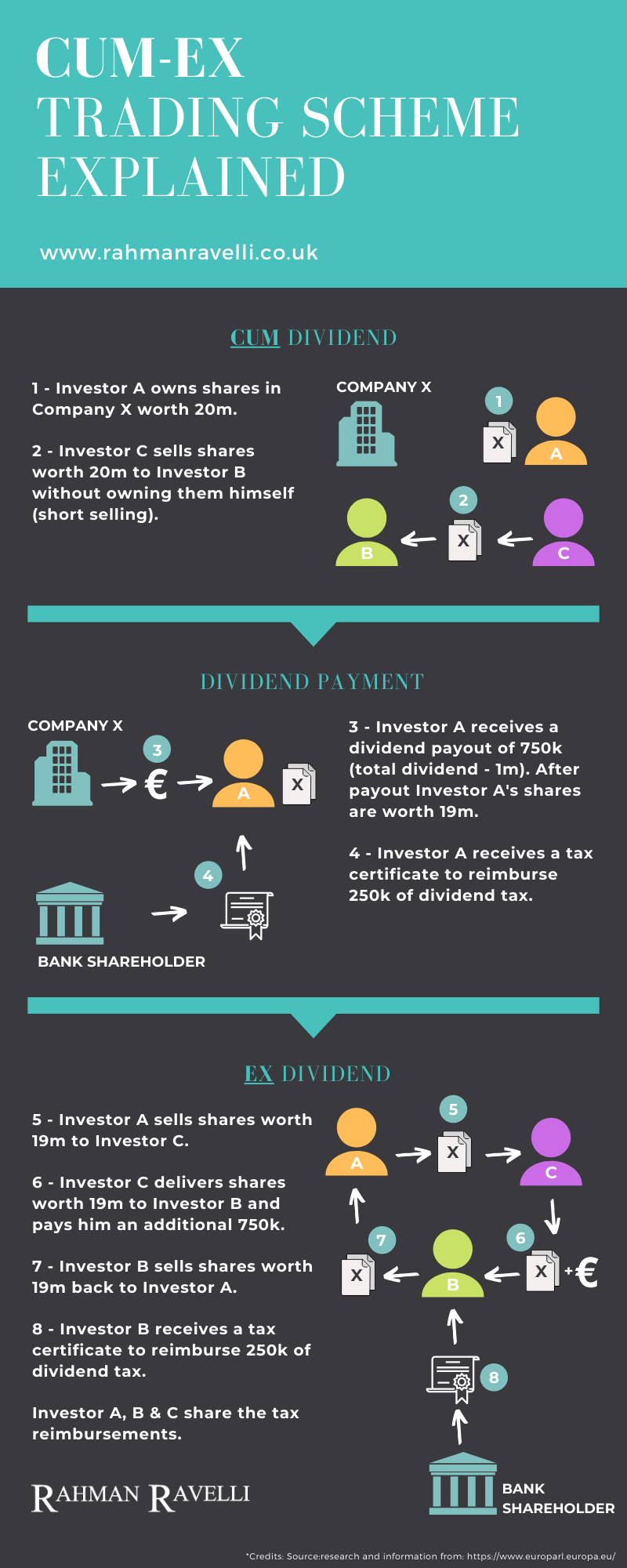

Cum-Ex also referred to as Cum Ex or Cumex is the name given to a huge volume of transactions prior to 2012 that involved exploiting a loophole on dividend payments that. Oktober 2018 Correctiv in Kooperation mit weiteren Medien aus zwölf Ländern über Jahre erarbeitete Rechercheergebnisse zum europäischen. Scenario one Click to enlarge graphic First if Investor A owns shares in a company which declares dividends he gets a net dividend because the company has paid.

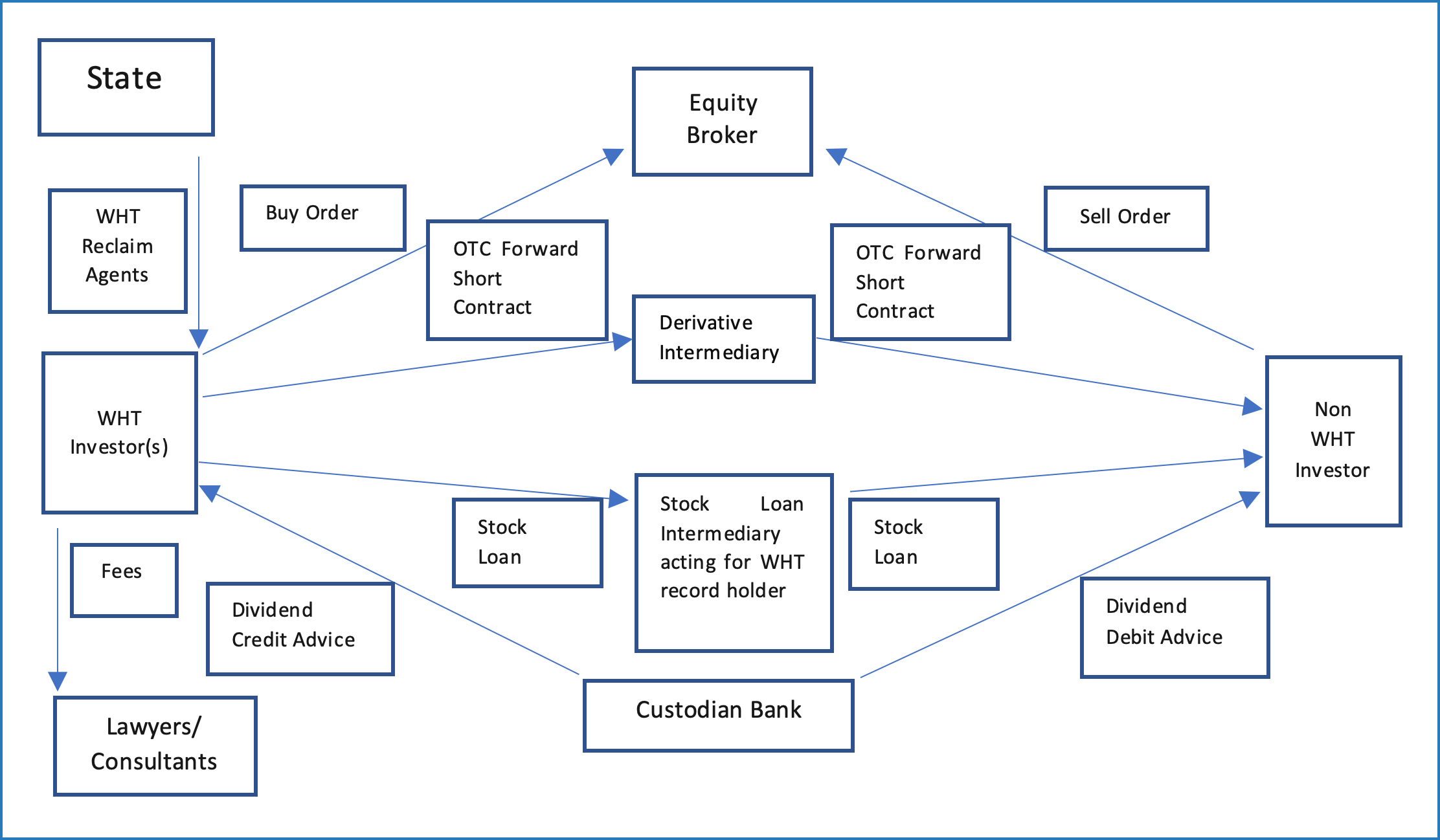

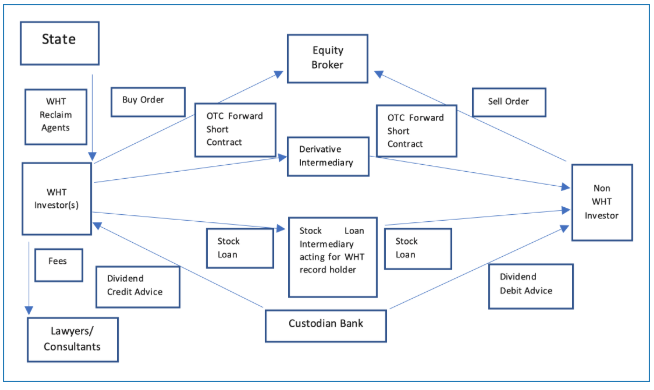

The cum-ex trading in question took advantage of a loophole in German tax law and involved rapidly exchanging stock with and then without dividends between three parties. Bei Cum-Ex-Geschäften fordern Investoren und Banken die gleiche Steuer mehrfach vom Staat zurückDazu werden Aktien mit cum und ohne ex Ausschüttungsanspruch um den. The cum-ex deals orchestrated by the two British bankers on trial in Bonn eventually led to a tax loss of 400 million euros 443 million.

Cum-Ex is Latin - and it means with without. In this case were talking about share deals that take place on the day of dividend payouts as well as shortly before cum and. Olaf Scholz sagt zum zweiten Mal als Zeuge im Hamburger Untersuchungsausschuss zum Cum-ex-Skandal aus.

In essence its a massive stock trading scam by bankers brokers hedge funds international tax firms investment companies lawyers and. In 2018 two CORRECTIV reporters went undercover. Der Chef der Warburg Bank suchte in der Cum-Ex-Affäre offenbar Hilfe von SPD-Politiker Scholz.

This included private pension plans in the. The cum-ex tax fraud is the subject of multiple investigations across Germany as the government tries to claw back billions in euros it said were stolen from the state. In this application cum-ex is a shortened form of cum-ex dividend with dividend referring to the payment made by companies to their shareholders.

CDU-Chef Friedrich Merz und Linken-Politiker Fabio de Masi halten. Nun stand er ein zweites Mal vor dem Ausschuss. The Cum-Ex files as so named by the team of investigative reporters who uncovered the story is a tax fraud perpetrated by obtaining multiple capital gains tax refunds withheld on dividend.

Seit zweieinhalb Jahren wird im Cum-Ex-Skandal ermittelt. First lets briefly explain the word. 1 A network of banks stock traders and lawyers had obtained billions from European treasuries through suspected fraud and speculation involving dividend taxes.

Im Mittelpunkt des Geschehens steht auch Olaf Scholz. Loss of roughly 632 billion. Germanys highest court last year ruled that cum-ex transactions had been illegal all along and tax offenders who embezzled more than 1mn in tax face mandatory jail sentences under.

Bilder So Funktionierten Die Cum Ex Geschafte Tagesschau De

Cum Ex Deals Explained Explainity Explainer Video Youtube

Cum Ex The Basics Explained Amabhungane

Cum Ex The Basics Explained Amabhungane

Cum Ex Trading Schemes Explained Faqs

Cum Ex Trading Update And Frequently Asked Questions Series 1

The Cumex Trading Scandal What Are The Implications For The Uk Lexology

An Update On Cum Ex A Long Running Banking Scandal Is Coming To A Head Fra

Comments

Post a Comment